Readiness of Medical Device industry for engaging with Bottom of the Pyramid Market

Readiness

of Medical Device industry for engaging with Bottom of

the Pyramid Market

-By Tanya Agarwal

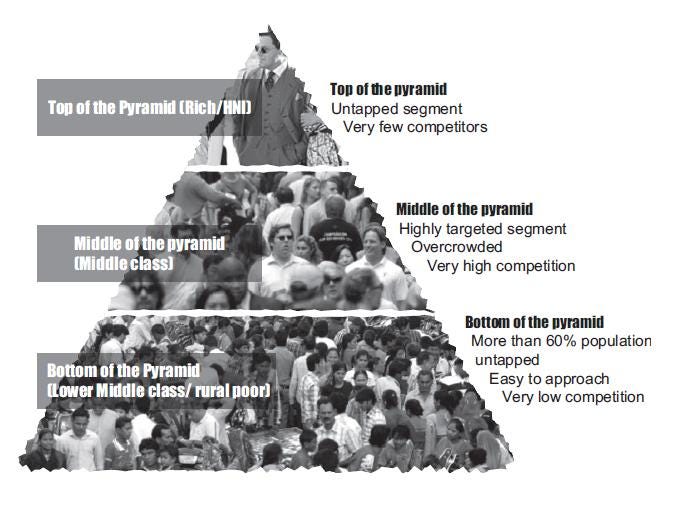

Bottom of the pyramid is

a concept which has been around for a while now. The term was first used by the

U.S president Franklin Roosevelt in his

radio address, ‘The Forgotten Man’, where he talked about how poor people are

often overlooked just because they live at the bottom of the economic pyramid.

The base of the pyramid or bottom of the pyramid is a term used by the

economist to refer the poorest two-thirds of the economic pyramid, a group of

more than four billion people earning less than USD2 per day. BoP gained momentum when management scholar C

K Prahalad and Stuart Hart came up with their groundbreaking article, ‘The

Fortune at the Bottom of the Pyramid’, in Stratergy+Business magazine, (later

converted into a book with series of case studies), where they argued that the

world’s poorest population are a vast, rapidly growing and untapped market and

the companies who serve these market can not only make massive money but help

eradicate poverty. It has now become a widely discussed topic in management

classes exploring new opportunities that lie for segments of different markets

and companies.

BoP is a population which

is consistently underserved when it comes to basic amenities, specifically

medical care. Poor health outcomes not only dampen human development but

overall economic growth. While many consumer good companies like Uniliver,

Godrej etc. have found their pot of gold at the bottom of the pyramid in India,

it’s time for medical device and equipment companies to leverage this

opportunity and target the untapped 70% of the population in rural India with

low-cost innovations explicitly developed and manufactured by domestic manufacturers.

According to a study by

Skp group, 69% of the Indian population lives in rural areas while 73% of

qualified consulting doctors reside in urban India. This gives an immense

opportunity to Indian manufacturers as well as multinationals to come up with

cost-effective products and innovations to carter the demands of that 69 % of

rural population with inadequate medical assistance. In medical device industry, the hospitals and

doctors are usually the customers, domestic manufacturers can gain by

tapping those practitioner working in rural and semi-rural areas as they would

be more loyal to these companies who would provide them with better and cost

effective equipment reducing their switching rates. There however lies a

greater opportunity for domestic players as the industry is already dependent

upon multinationals contributing to 73- 75% imports of devices and equipment,

the domestic players can target the rural population as their new segment and

make a dominant presence in tier 2 and 3 cities.

Few multinationals have

already started experimenting with BoP business model strategy by innovating

technically advanced yet affordable equipment. For example GE Healthcare, the

global manufacturing company, known for its premium products across the world

and India, faced a supreme challenge to bring a low-cost medical device to the

rural Indian Territory. They spend enormous time to develop an in-depth

analysis of their customer requirements and problems faced by the users of the

products. They found out that doctors and small clinics in rural areas cannot afford the existing premium electrocardiography (ECG)

machines as their patients had a lower-paying capability. In addition to this,

the existing model of ECG machines was bulky and heavy, need trained operator,

and require extensive service support with continuous electricity supply. The

company overcame this challenge by introducing their Mac 400 series of ECG

machines which was not only affordable that runs on battery but easy to use,

robust and require way lesser maintenance. Portable Mac 400 machines cost less

than a fifth of the conventional ECG machines available in the market. They now

have rolled out a newer version of the device, MACi with a slightly heavier

processor. They also observed that people

kept pre-mature babies warm with a 200watt bulb and this need couldn’t be

filled through existing models of incubator and de-featuring it to a lower

price, instead they developed an affordable Lullaby Warmer which was easy to

use with single function buttons with easy-to-follow graphics instructions

making operation simple. The company has developed around 28 portable devices like

ultrasound machines, CT scanner and X-ray machines, under the campaign, ‘In India,

for India’, which are not only affordable but backed by newer technology

requiring lesser power and technical knowledge to operate while addressing the

unmet needs of the people at the bottom of the pyramid.

Philips India is another company which has delivered cost

effective products to bridge the rising healthcare needs of rural India. They

recently unveiled their campaign ‘Affordable technological Solutions’ on

wheels- IntelliSafari. Featuring a mobile van- the IntelliSafari which reached out

to hospitals, nursing homes and clinics in Tier 2 and 3 cities in India and

made them aware of the latest technological advancements in healthcare,

available at a low cost. The van was equipped with devices to treat patients

from dusts to infants in ICU, CCU, general wards and nursing care units. The

company has developed many such products under in country, for country

campaign.

However, domestic players have also started to develop

products that are cost efficient and affordable for billions of people who

don’t have access to premium healthcare.

Domestic players such as Jaipur foot, developed a complete

limb which costs less than $40 including a prosthetic foot made of wood and

sponge rubber, which itself costs less than $5 and can be made in under 3

hours. Alternatively cost of a prosthetic limb in developing countries usually

ranges from $125 to $2,000 which is quite high in comparison to Jaipur foot’s

product.

Another company Biosense Technologies brought high quality yet low cost

products to Indian masses. They develop simple to use

diagnostic devices that are non-invasive and makes use of smart phones for

screening diseases, making it a viable solution in remote areas where trained

medical professionals are few and far between. They have launched devices like

TouchHb, uCHeck, and SuCheck. TouchHb is a portable, needle free

anemia-screening tool that requires no expensive equipment and little training

to use. ToucHb allows local health workers to painlessly test patients,

immediately read results, and administer treatment where necessary. Similarly,

uCheck and SuCheck are smart phone based portable urine and blood sugar

screening tools respectively that make use of a cloud based operating system to

estimate the results accurately.

Due to favorable government policies and initiative like

make in India, 100% FDI, GST and rising expenditure on healthcare along with

increasing penetration of mobile phones with internet and rising incomes,

medtech companies are now shifting to a holistic market view where they don’t

only want to serve the premium but the rural segment as well to get a greater

market share.

There are maby players who have sensed an opportunity to

serve this gold mine at the bottom of pyramid to gain a bigger piece of pie.

There

are many such multinations including Medtronic, Johnson & Johnson and

Siemens Healthcare etc. which have started leveraging the R&D to develop

more affordable and technological advanced products which are more suitable for

Indian consumers.

Well said that big companies are not adopting such strategies and thinking about those who were neglected earlier.

ReplyDeleteFacts written down very beautifully, thanks for the insights

ReplyDeleteWell written article

ReplyDeleteIt's all about making use of the right opportunity at the rught time!

ReplyDeleteWell written

ReplyDelete